Black Friday and Cyber Monday sales are a great way to save some money and snap up terrific deals.

Here’s a guide to tips – and traps to avoid – to make your online bargain hunt a success, from finance guru Effie Zahos.

Christmas is fast approaching, and this year cost of living pressures mean plenty of households could be strapped for cash.

That makes the upcoming Black Friday sales a chance to put some bargain buys under the tree.

Black Friday is a US tradition that’s fast catching on in Australia, and falls this year on November 25, with Monday November 28 being Cyber Monday, when the discounts go online.

How much can you save?

Black Friday is quickly becoming one of the must-do sale events of the year.

(Credit: (Image: Getty Images))If you think the Boxing Day sales offer value, just wait until you see what Black Friday has in store.

Retailers usually announce Black Friday discounts close to kick-off date.

But as a guide, last year Myer cut the cost of popular espresso machines by $400. Rebel Sport raced into the action with 50 per cent off footwear, and JB HiFi kept the party rolling on Cyber Monday with savings worth $1000s on flat-screen TVs.

It’s helping to make Black Friday the must-do sale event on the calendar.

A survey by Power Retail found 58 per cent of shoppers save up for the Black Friday bargain bonanza, while only 40 per cent tuck away cash for the Boxing Day sales.

Five traps to watch out for

Black Friday can be fun and exciting – especially if you avoid key traps that can take the shine off your savings. Keep an eye out for:

The added cost of freight

If you’re shopping online, remember the cost of freight won’t usually be discounted.

Foreign conversion fees

Money watchdog ASIC says international transaction fees can add an extra 3 per cent onto the price of items purchased from overseas websites. To know what you’ll pay, check the fine print of a website, or consider a credit or debit card that offers fee-free international transactions.

Delays to festive season shipping times

There’s not much point saving $100 on a Christmas gift for someone if they don’t receive it until February. Australia Post warns that COVID disruptions can cause delays, so look carefully at a website’s delivery times – and allow a bit extra.

Make sure to look carefully at a website’s delivery times as their may be delays due to COVID and other factors.

(Credit: (Image: Getty Images))Hidden payment costs

The way you pay for bargains can eat up any savings. If you’re paying with a credit card, only pay for purchases you can pay off before interest charges apply. If you are tempted to use ‘buy now, pay later’ (BNPL), remember it’s not always cost-free. Financial Counselling Australia crunched the numbers and found a BNPL user who incurred late fees or account keeping fees could pay an effective interest rate as high as 49 per cent. Aim to stick to a debit card – it’s hard to go wrong.

Scammers

Australians lost $8 million to online shopping scams last year. Play it safe by sticking to trusted websites or those displaying a padlock icon in the website address bar. Better still, look for sites with two-factor authentication. The retailer will send an SMS to your phone, which you then type into the site for the sale to go ahead. It reassures everyone that there are no scammers involved.

You’re all set to go bargain hunting! If you don’t find what you’re looking for, rest assured, the Boxing Day sales are just around the corner.

Play it safe by sticking to trusted websites or those displaying a padlock icon in the website address bar.

(Credit: (Image: Getty Images))Seven steps to supersize your savings

An event like Black Friday can be worth planning for. Try these strategies to maximise the value.

Make a list of buys

A bargain is only ever good value if you really need the item. So, make a list of essential purchases – from festive gifts to items needed for the family and home.

Sign up for early bird alerts

Retailers such as Kogan have already announced Black Friday savings of up to 40 per cent. To give yourself a head start on all the bargains, consider signing up for retailers’ email alerts.

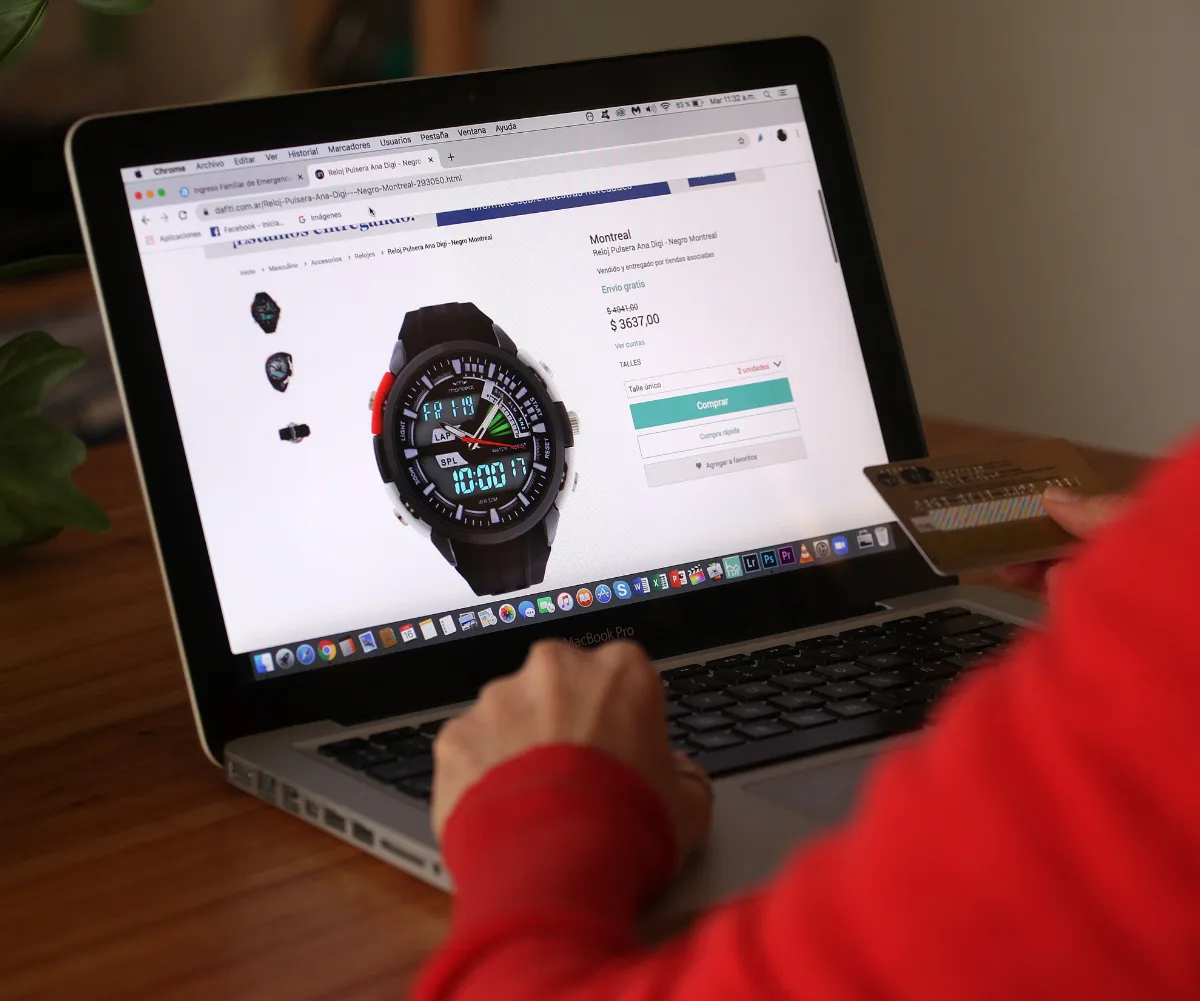

Go digital to score the best deals

Comparing prices is always a good idea. But trudging from store to store is a time-waster that could see you miss out on marked-down, big-ticket items that may be in limited supply. Instead, use digital tools like Google Shopping to compare prices, or download price comparison apps such as Shopular, ShopSavvy, BuyVia or ScanLife to see which stores offer the best value.

Save with cashback sites

Signing up to cashback sites like Cashrewards and ShopBack costs nothing. But they can supersize your Black Friday discounts. Cashback sites receive a commission when you make a purchase via the site, and part of that money is returned to you as a cashback payment. How much you receive varies according to the brand you are buying.

Make use of reward points

Now’s the time to check the points you’ve accumulated through popular reward programs like Woolworths Everyday Rewards or Coles Flybuys. Redeeming points at the check-out can see you land a juicy Black Friday discount at no cost at all.

Pay with a gift card

Think back to last Christmas. Chances are you received a few gift cards that have spent the past year languishing in your handbag or lying forgotten in drawers around the home. Now’s the time to put those cards to work. What could be better than scoring a bargain for free?

Hold on to your receipts

It can be so disappointing when Grandpa unwraps his elf-themed boxer shorts on Christmas Day only to find the waist elastic is broken. Signs that say “no refunds on sale items” are illegal, according to consumer group Choice, but you usually need proof of purchase to get your money back.

You can read this story and many others in the November issue of The Australian Women’s Weekly – on sale now